Kiernan Gange

📜 CV 📜

Work Experience

Inference Economics – Founder, Lead Economist (2021–Now)

Founded and lead a boutique economic advisory firm focusing on policy, Indigenous economics, natural resource economics, conservation finance, and litigation support. In the "Interests" section of this site I explore why I find my work meaningful. In short, my intention as a partner at Inference is to be a resource to organizations that have traditionally been underserved by existing institutions or marginalized by Canadian society at large. In particular, the Canadian government and private industry often have outsized negotiating power when dealing with small communities or Indigenous people. This imbalance of power has been a hallmark of Canadian society since Canada's inception and is at the root cause of many of the structural flaws in our society.

Martin Family Initiative – Assistant Evaluation Scientist (2020–2021)

Supported program evaluation for Indigenous education initiatives, producing data-driven reports and insights for leadership. Much of this work was focused around data management and analysis related to education programming for teachers on First Nations. It was a really fun job! I quit to begin running Inference alongside my business partner.

University of Winnipeg – Sessional Lecturer, Economics (2019–2020)

Taught undergraduate micro and macroeconomics as I was mulling over getting a PhD (ultimately decided against). COVID forced classes online and took away the joy of teaching. Here's my RateMyProf. One student said I was horrible and another said I was rarely funny. Otherwise fairly positive reviews.

Education

University of British Columbia – MA in Economics

My graduate research paper focused on the impact on community well being of opting out of several sections of the Indian Act for First Nations in Western Canada. The results were mixed. The analysis was based mostly in Stata using Statistics Canada data.

University of Winnipeg – BA (Hons) in Economics

Gold Medal in Honours Economics winner. Here's a profile on me included in the annual report of my graduating year.

🧠 INTERESTS 🧠

cities, urbanism

- Kijiji rental daily scraper – A friend of mine told me he found an apartment super easily in toronto by building a craigslist scraper. When I was looking for a new place, I decided to do the same thing. This script scrapes kijiji everyday and then stores new listings on my google drive. I didn't find an apartment this way, but at this point I keep it around because it's kind of like having a houseplant. It's just nice to tend to it and let it do its thing. On my github there's a similar one for Craigslist.

-

Heterogenous Apartment Listing Platform Preference by Geography

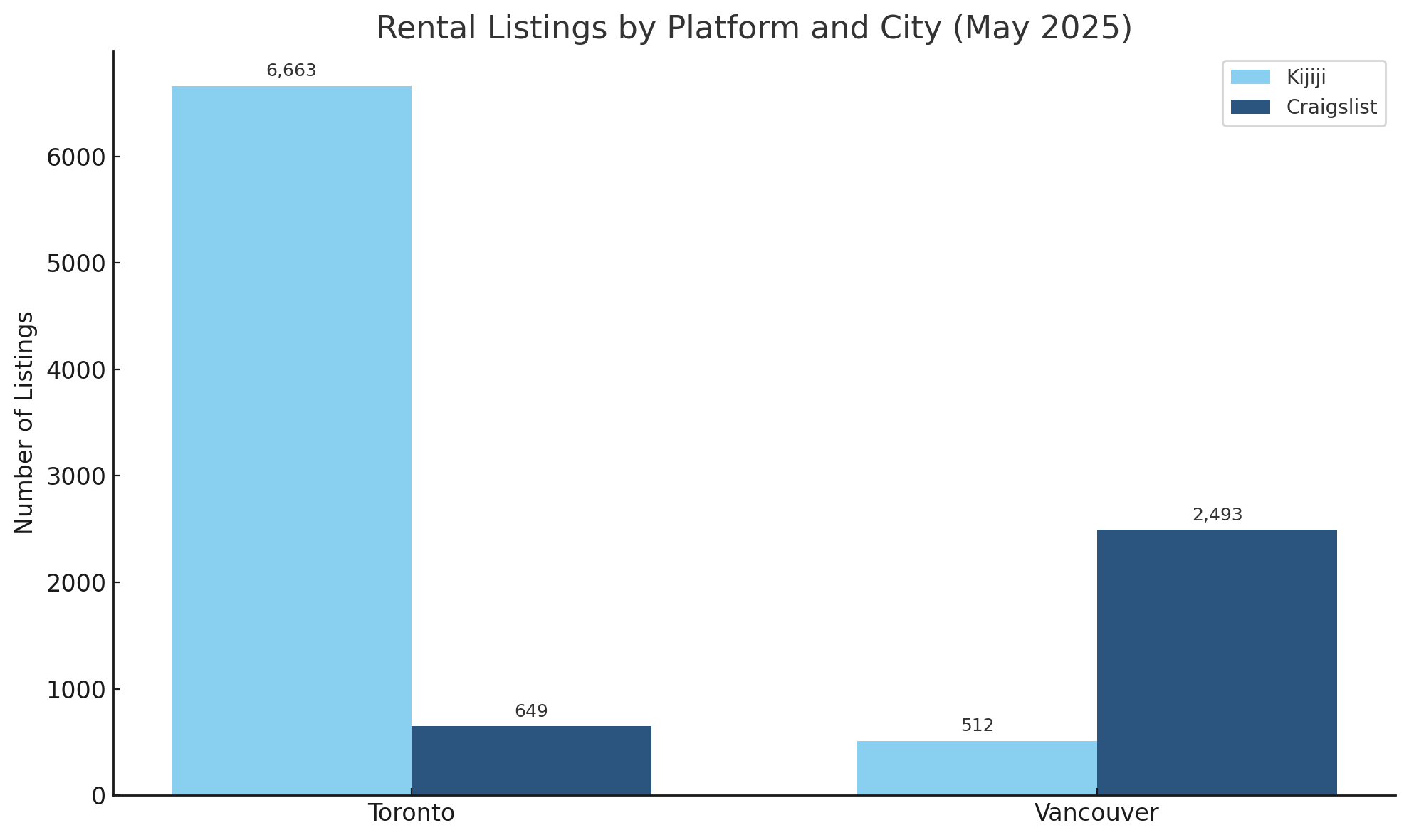

- This is the fanciest way I can say that you have to look on different websites for apartments depending on what city you're in. This is an issue because it makes it harder to move cities and you end up spending more time looking for deals. The difference between Vancouver and Toronto:

Kijiji dominates in Toronto and Craigslist dominates in Vancouver (this is from one month, sure, but this is just illustrative), and that doesn't take into consideration other platforms like RentFaster or Marketplace or Realtor.

Here's the other reason why it matters: In this situation, there's an information asymmetry that really only benefits people that own a ton of properties and can collect their own data, or people that are professionals and spend their time posting on these platforms frequently. It harms the renter, and the "mom and pop" landlords that don't have a sense of what a fair price in their market is.

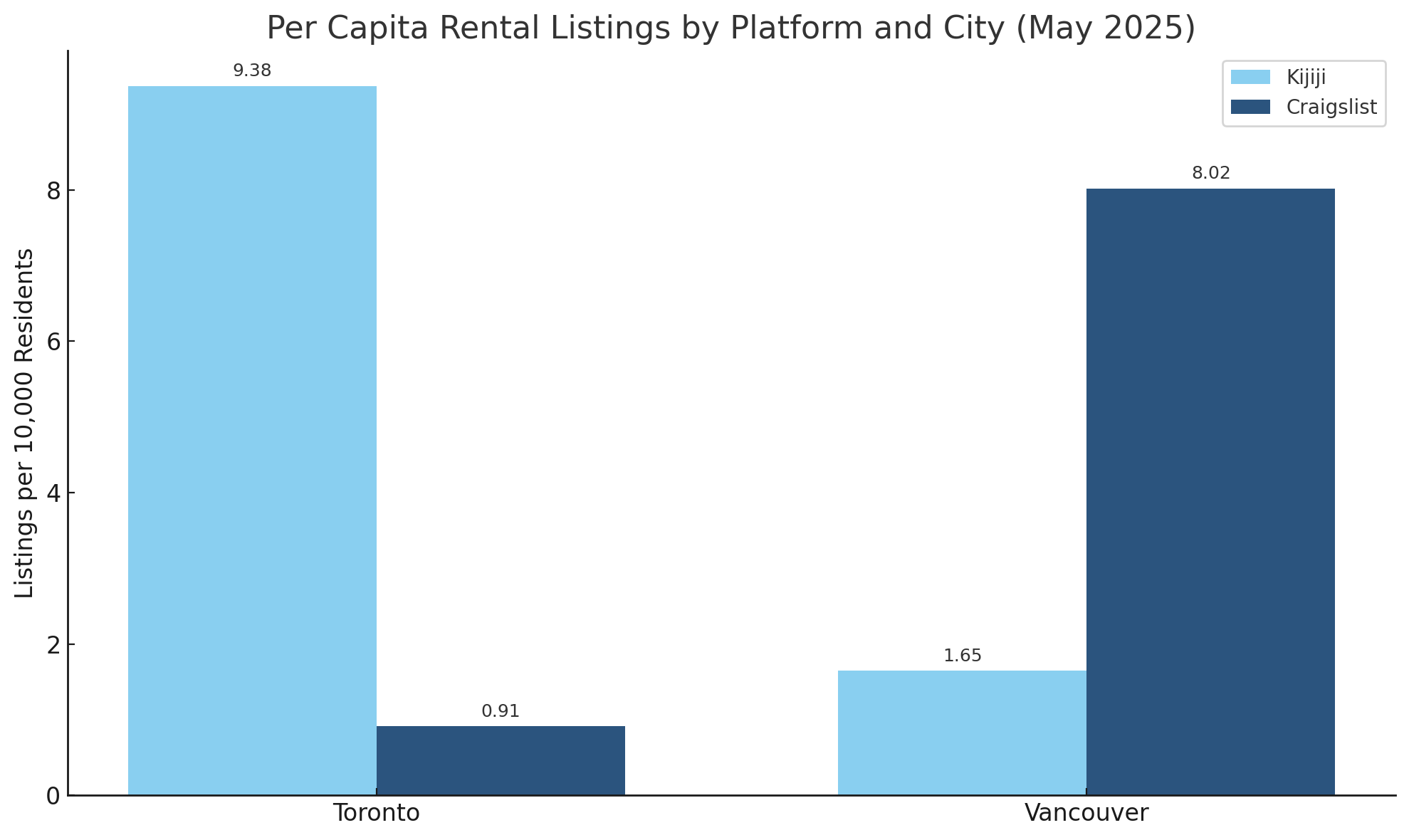

Here's the same chart per 10,000 residents of each city's respective metro population.

In an ideal world, in my opinion, the government should have their own platform that automatically connects to CRA and allows renters and landlords to either report income easier or claim benefits easier. Competition between platforms does not generate a superior product but instead increases search costs and harms consumers.

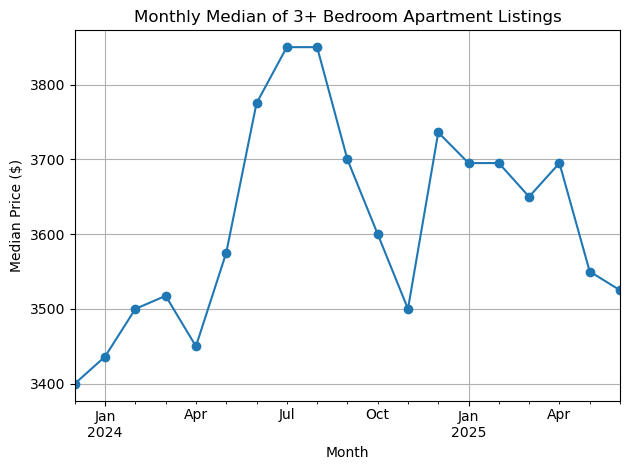

- 7-day average for Toronto Apartment prices on Kijiji

Using Kijiji data we can see how the 7-day median prices of new listings in Toronto has evolved over time. This chart updates automatically. This pulls directly from the google sheet that the data is stored in, so outliers remain in the dataset and can occasionally skew the data. Additionally, I group 3+ bedrooms together, so there are occassionally groups of listings that skew that series. The intention of this data is to create a time-series of rental listings that would have predictive power over trends in the rental market.

-

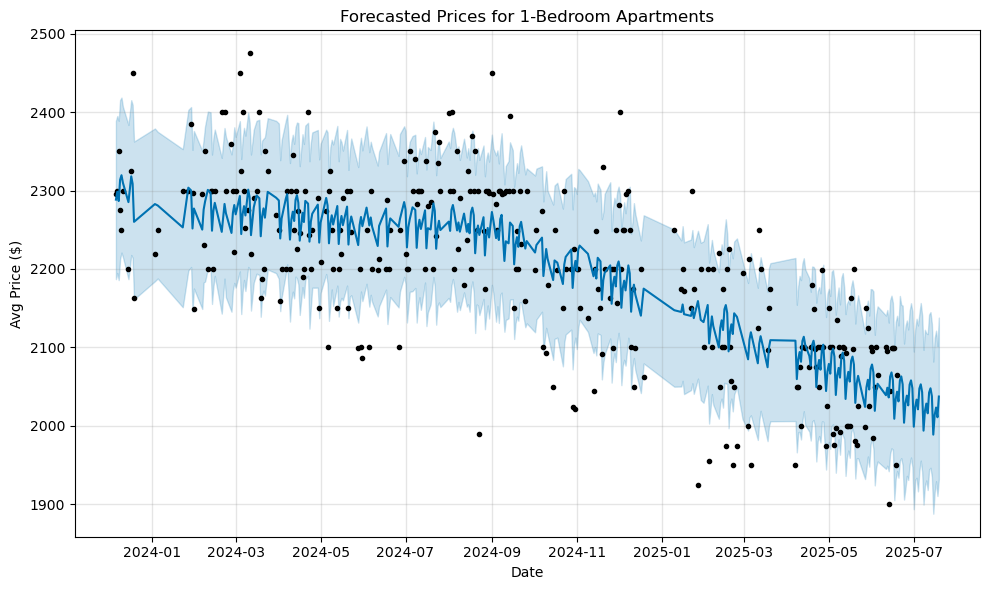

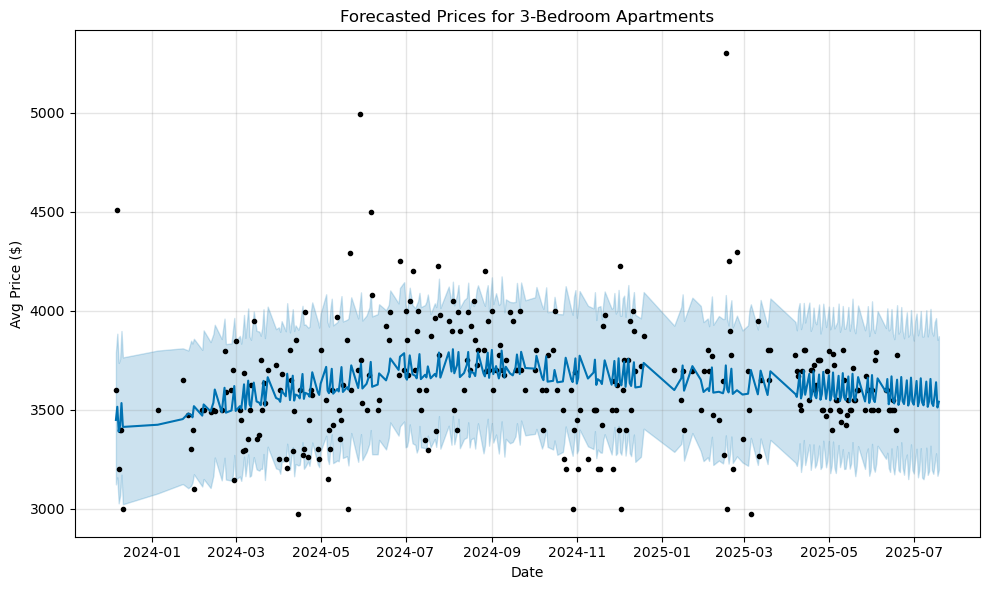

Forecasting rental listings using Prophet and Kijiji data

– A benefit of the above scraper is that it generates a sufficient quantity of data to support forecasting. Here's a snapshot of what it can do:

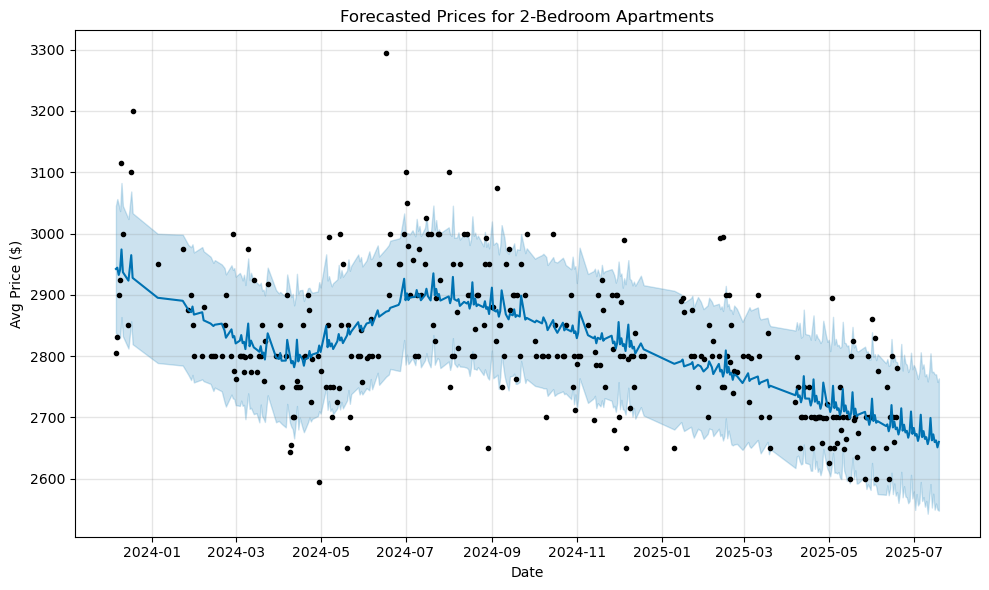

Taking the median daily price (after cleaning the data and removing outliers) shows the downward trajectory—as of June 2025—of the asking price for 1-bedroom apartments in Toronto. Expanding this to 2-bedroom units:

shows a similar downward trend, although prices briefly peaked in the summer of 2024. Expanding again to apartments with 3 or more bedrooms:

shows that prices—while noisier due to grouping—follow a similar pattern to 2-bedroom units. However, prices have not fallen below 2024 levels. Looking at the monthly median price:

shows a similar spike in the summer of 2024, with another peak in December 2024. All of this is relevant when assessing the impact of supply on rental prices.

🇨🇦canadian economic development🇨🇦

⚖️political economy⚖️

🚵 HOBBIES 🚵

Here's everything I spend my time on outside of work. Most of them I am not great at.- Cycling – There is no joy greater than riding a bicycle

- Running – Incredibly meditative and painful

- Lifting weights – Also meditative but not painful

- Weaving – Training myself to pay greater attention to detail through textile art

- Chess – Chess is incredibly fun and frustrating and playing it has demystified the concept of being a game for geniuses

- Billiards - Fun, meditative, a real game for geniuses

🤝 THINGS I LIKE 🤝

📚Books I like📚

- Culture Series, Iain M. Banks – Books about a post-scarcity, spacefaring society in which humans and AI co-exist. Made me infinitely less anxious about the prospect of AGI.

- Death and Life of Great American Cities, Jane Jacobs – I think this is one of the greatest books about the value of community and the urban fabric in cities. Lots of insights about the differences between small towns and how we socialize.

- The Otherside of Eden, Hugh Brody – An autobiography of an anthropologist in Canada. Greatly contextualizes the differences between hunter-gatherer lifestyles with agrarian societies and how that relates to the impacts of colonization in Canada.

- The Break, Katherena Vermette – An amazing story about the North End of Winnipeg and the interconnectedness of struggle in the city

🎨Artists I like🎨

- Bronwyn Butterfield – Bronwyn is a beader from Winnipeg who makes insanely beautiful pieces

- Craig Boagey – Craig Boagey makes incredibly detailed paintings of brain-rot esque images

- Armando D. Cosmos – My personal GOAT

- Kayla Mattes – Consistently the most entertaining and creative

Other things I like

- Primo's – Best lunch in Winnipeg

- Shirley Company – Best Toronto local streetwear company

- Heroes of Might and Magic III – Best computer game ever made

Places I like

- Mexico City – Mexico City is truly a world class city and one of the pinnacles of urbanism. Everyone should visit at least once.

- Todos Santos – Beautiful Mexican desert oasis

- Lester Beach, MB – Idyllic lakeside community on the eastern shores of Lake Winnipeg